HIGHLIGHTS

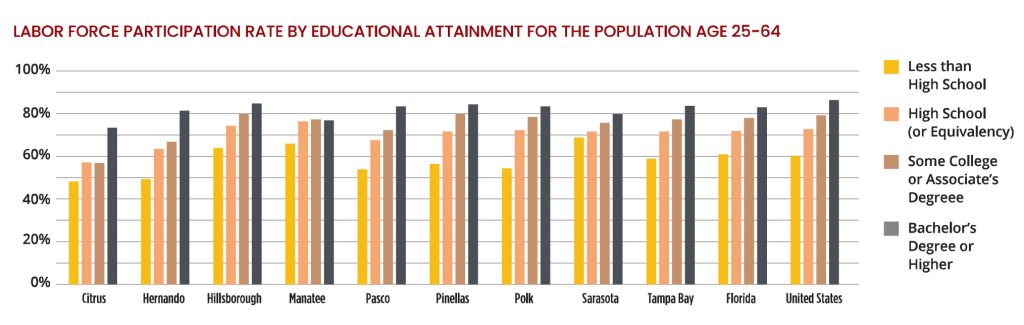

- A strong connection between education attainment and labor force participation exists; in Tampa Bay, fewer than 60% of the population with no high school diploma or equivalency participates in the labor market.

Our new site includes interactive dashboards for each indicator. Make the most of the data. See How

Economic Vitality measures the quantity and quality of jobs within a region, the relative incomes that its residents earn, the wealth they attain, and economic opportunities for its entrepreneurs.

Innovation measures the extent to which a community and its institutions are generating new ideas and inventions, and the market’s reception of these ideas.

Infrastructure measures the quantity and quality of the investment a region makes in underlying structures, including transportation and broadband internet.

Talent measures who is working today, and how well the region’s talent pipeline is being prepared for the jobs of tomorrow.

Civic Quality measures the affordability of a region, the health and safety of its citizens, and the recreational opportunities that impact its quality of life.

Outcomes measure the growth of the regional economy, the extent to which economic growth is being enjoyed by everyone, and the attractiveness of the region for its current and potential residents.

For the purpose of the Regional Competitiveness Report, the data presented for the Tampa Bay region reflects the eight counties of Citrus, Hernando, Hillsborough, Manatee, Pasco, Pinellas, Polk, and Sarasota.

The Tampa Bay Partnership is a coalition of regional business and nonprofit leaders, joined by a shared commitment to improving the personal and economic well-being of Tampa Bay residents. Through its foundation, the Partnership conducts objective, data-driven research to identify the region’s greatest challenges and measure our progress toward shared community goals. This work includes the Regional Competitiveness Report, which helps measure our region's performance against other communities nationwide.

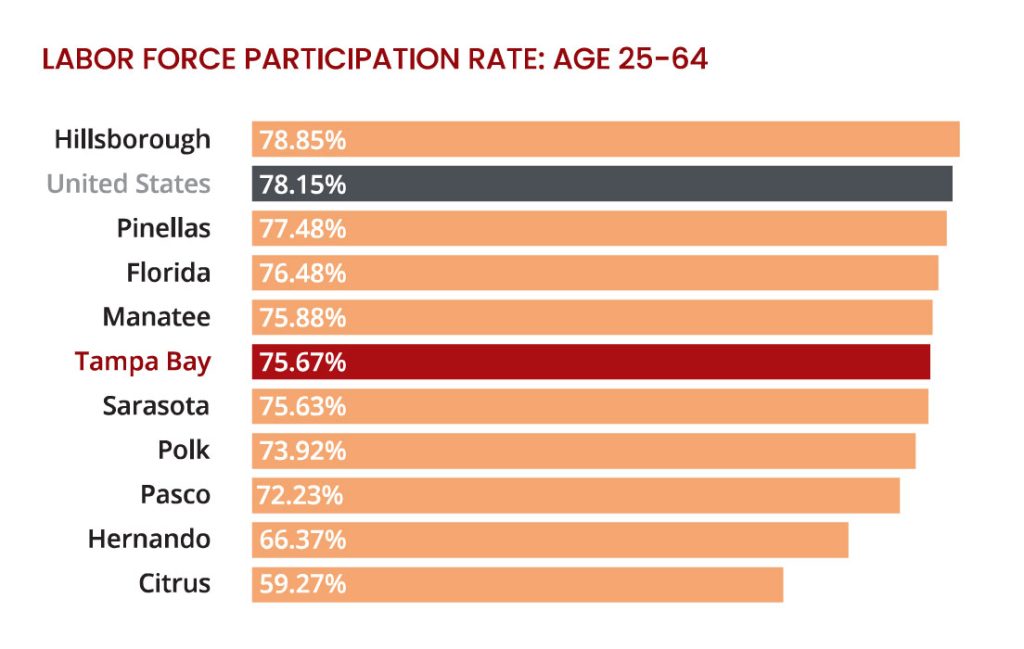

Labor Force Participation Rate is the share of the population that is either employed or seeking work. In the last three annual editions of the Regional Competitiveness Report, Tampa Bay’s Labor Force Participation Rate Age 25-64 has consistently ranked last, and typically by a significant margin.

As with any of our indicators, the Tampa Bay value is the sum of its geographic parts, and the chart on the right provides a disaggregation of the indicator by geography, with the state and nation added for context.

Hillsborough is the only county that bests the national figure for labor force participation rate age 25-64. Manatee and Pinellas top the regional figure, the latter also surpassing the state labor force participation rate.

In addition to geography, we view labor force participation rate by educational attainment, which has a positive correlation with labor force participation.

Education is a significant investment of resources- both time and money. As personal investment in education increases, and resources are expanded, there is a definite trend to recoup that investment via work. In Tampa Bay, fewer than 60% of the population with no high school diploma or equivalency participants in the labor market. Conversely, Tampa Bay residents with a bachelor’s degree or better exhibit an 82% labor force participation rate. Tampa Bay’s relatively low levels of educational attainment are likely dampening labor force participation.

Perhaps one of the greatest determinants of labor force participation is age. Young adults may choose to pursue education prior to entering the workforce, many workers between the ages of 25 and 34 years of age step away from work temporarily to raise young children, and with advancing age brings any number of impetuses retirement, declining health, or physical ability for exiting the labor force. The following charts dissect Tampa Bay’s labor force by age and geography.

Across all geographies, labor force participation dramatically increases from the 16-19 age cohort to the 20-24 age group, nearly doubling as residents exit secondary or post-secondary schools and enter the workforce. A slight downward trend is exhibited from the 25-29 to 45-54 age brackets suggesting that individuals are far more likely to leave the workforce versus entering it at these ages. Alternatively put, in Tampa Bay, individuals aged 25-29 are more likely to be in the labor force than any other average individuals or different ages. A rather precipitous decline in labor force participation rates occurs from age 55 to a near full exit from the labor force after age 75.

Drilling into the age segment 25-54, distinctions between the communities are more clearly visible. The majority of counties- as well as the state and nation- exhibit similar patterns of Labor force participation. Divergences include Sarasota’s 90% plus participation rate for the 25 to 29 cohort, as well as steeper drop offs in labor force participation rate among Hernando, Citrus, and Pasco counties, which may be due to influxes of early retirees.

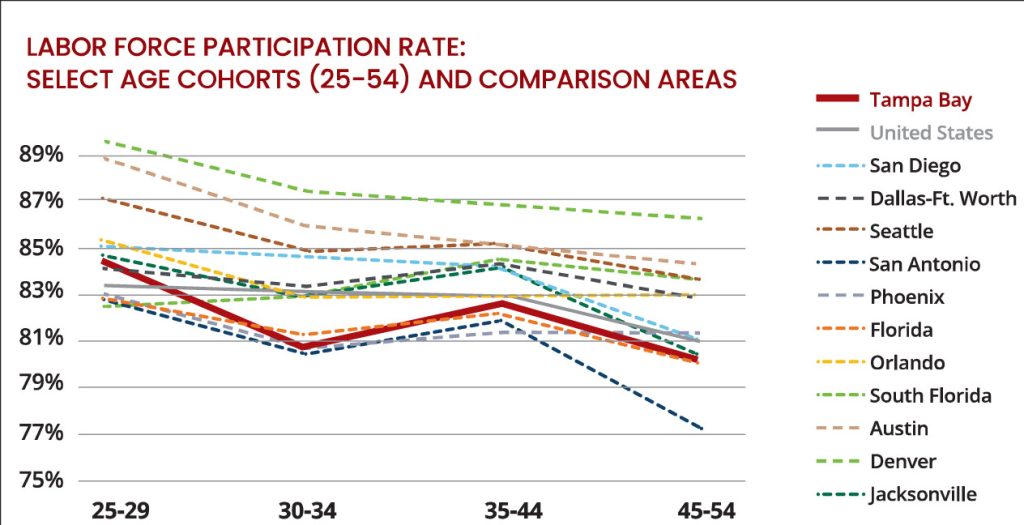

We also view Tampa bays labor force participation rate in the 25 to 54 age group in comparison to other Florida markets (Jacksonville, Orlando, South Florida), retirement havens (Phoenix, San Antonio, and San Diego), and a handful of perennial top performers to see what inferences may be drawn.

Tampa Bay tracks the Florida markets in sunbelt retirement destinations, in large part. In most of the select comparison communities with high gross regional product per capita (Dallas Fort-Worth is an exception), labor force participation rates at ages 25-29 generally outperform Tampa Bay and labor force attrition through age 54 is not as pronounced. In other words, high performing communities have relatively stronger and more resilient labor force participation rates across the prime working years of 25-54.