HIGHLIGHTS

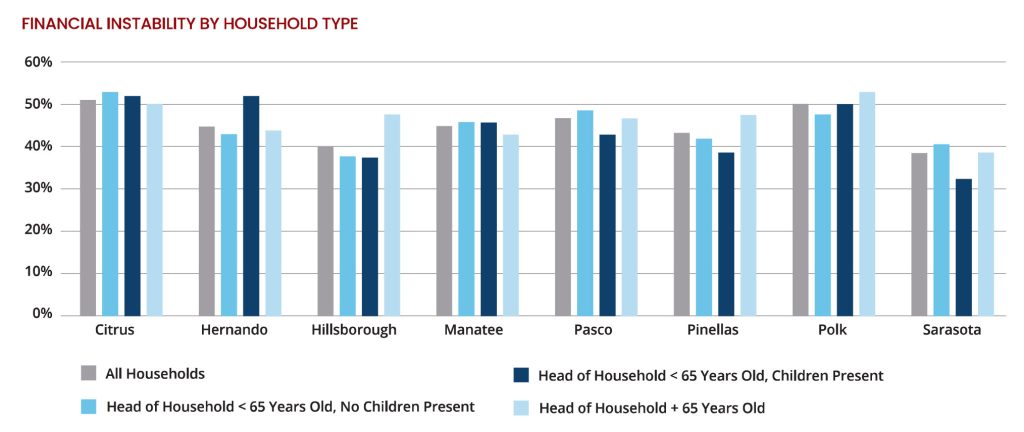

- In Tampa Bay, nearly 770,000 households, 43% of the total have incomes below the ALICE threshold and can thus be described as in a state of financial instability.

- Financial instability varies widely within the communities of Tampa Bay, and within household types. Households headed by an individual 65 plus years of age are more likely to experience financial instability in Hillsborough, Pinellas, and Polk counties, relative to other household types, and vis-a-vis the rest of the region.

Prosperity has many definitions, but certainly a set of circumstances that result in daily choices between paying for monthly utilities or rent, or between paying for quality childcare or nutritious food, would not easily be included in those definitions. “Survival” is rarely employed as a synonym for “prosperity”. In Tampa Bay, and in communities across the nation, many working residents are faced with tough choices listed above dash and others dash and as a great result are unable to build their personal finances. Through a national research effort comma last published in 2018 comma united way has given this segment of the population a name: ALICE.

ALICE is an acronym for Asset Limited, Income Constrained, Employed, and identifies, on a market-by-market basis, the share of the working population (at a household level) that is working finds themselves above the uniformly defined federal poverty line, but also generally unable to make ends meet based on a basket of necessary household goods and services. These expenses at a bare minimum standard, are dubbed in the research as Household Survival Budget and include Housing, Childcare (for families with children), Food, Transportation, Health Care, Technology, Taxes, and a Miscellaneous contingency fund.

“Financially unstable households are at a great risk for a host of negative related outcomes, including lower educational attainment and increased residential transience.”